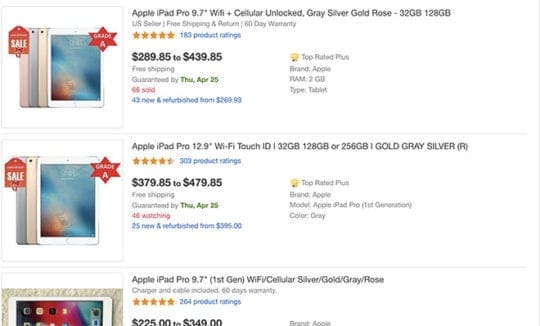

Aug 02, 2013 You can buy 365 days of the year sales tax free in some states, the difference paying for Apple Care. I intend to deprive state government as often as possible on ridiculous amounts of tax on. Jul 31, 2018 While that makes Mac products ineligible, you can pick up most of Apple’s iPad lineup tax-free. You could also buy accessories under $500 tax-free, including an Apple TV — which qualifies as a.

You can only buy tax-free goods from shops in Great Britain (England, Wales and Scotland) if they’re delivered straight to an address outside the UK. Check with the retailer if they offer this service.

You may be able to buy tax-free goods from some shops when you visit Northern Ireland. You claim your VAT refund when you leave Northern Ireland or the EU.

When you may be able to get a VAT refund

You can sometimes get VAT refunds on goods you buy in Northern Ireland if you:

- visit Northern Ireland and live outside the UK and EU

- work or study in Northern Ireland but normally live outside the UK and EU

- live in Northern Ireland but are leaving the UK and EU for at least 12 months

You can only get a VAT refund if you take the goods out of Northern Ireland and the EU within 3 months of buying them. Not all retailers offer VAT refunds.

Taking goods from Northern Ireland to Great Britain

You will not get a VAT refund if you travel straight from Northern Ireland to Great Britain.

If you travel from Northern Ireland to Great Britain through another country, the goods will count towards your tax-free personal allowances. You may have to declare them along with other goods you’re carrying when you enter Great Britain and pay import VAT.

This may mean you have to pay VAT again on the goods from Northern Ireland. If this happens, you can get a refund of the overpaid VAT from the retailer.

Check the rules on bringing goods into Great Britain.

How to get a VAT refund

Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.

Show the goods, the completed form and your receipts to customs at the point when you leave Northern Ireland or the EU.

Customs will approve your form if everything is in order. You then take the approved form to get paid.

If you’re changing planes in an EU country and checking your goods with your luggage, you must do step 2 in Northern Ireland when you check in.

Getting paid

Buy Mac Tax Free Account

You can either get paid immediately at a refund booth, for example at the airport, or send the approved form to the retailer or their refund company. The retailer will tell you how you’ll get paid.

Buy Mac Tax Free Edition

Some retailers charge a fee for handling your form. This money will be deducted from your refund.

If there are no customs officials available, you can leave your form in a customs post box. Customs will check it and contact your retailer to arrange the refund if everything is in order.

Goods you cannot get a refund for

You cannot get a VAT refund for:

- mail order goods, including internet sales, delivered outside of Northern Ireland

- goods you’ve already used in Northern Ireland or the EU, such as perfume

- service charges, such as hotel bills

- new or used cars

- goods worth more than £600 exported for business purposes

- goods to be exported as freight

- goods that need an export licence (except antiques)

- unmounted gemstones

- gold over 125g, 2.75 troy ounces or 10 tolas

- a boat you plan to sail to a destination outside Northern Ireland or the EU

Apple Tax Free Holiday

Find out more about claiming VAT back on tax-free shopping in Northern Ireland, including travelling to Great Britain and problems like losing your form.